Sell your home faster.

Access professional buyers, structured offers, and real liquidity in 24–72 hours, without listings, showings, or delays.

No listings. No waiting. No discounts. Just fast, verified execution.

Get offers in 24-72 hours

Choose the down payment and payment plan

We handle closing and servicing end-to-end

Not ready? Get a free estimated terms preview in 60 seconds.

Real estate finally moves at modern speed.

Traditional real estate makes sellers wait.

SellFi creates instant liquidity by connecting you directly to professional buyers actively acquiring on terms.

Higher pricing than cash offers

Cash buyers demand a discount.

Terms buyers pay closer to full value.

Control your terms

Set the down payment.

Choose the timeline.

Create predictable monthly income.

Institutional-grade execution

We verify buyers, coordinate professional title and closing, and service payments end-to-end.

Why the old real estate process is limited.

When you list a home traditionally, you're marketing to one buyer pool:

retail buyers dependent on bank financing, contingencies, and slow timelines.

Cash Investors move faster, but almost always demand deep discounts.

That's the entire market.

Traditional Listing

• One buyer pool

• Financing contingencies

• Appraisal & lender delays

• Uncertain closing timelines

Cash Investors

• Faster closings

• Limited demand

• Heavy price discounts

• One-off negotiations

Speed comes at a cost.

SellFi

• Institutional and professional buyers

• Structured terms, not discounts

• Real down payments

• Predictable execution

SellFi opens access to a different buyer pool entirely.

We connect sellers directly with professional investors, funds, and institutions that actively acquire properties using structured terms.

These buyers prioritize speed, certainty, and execution,

not discounts.

The result:

More demand from serious buyers

Better pricing without cash discounts

Faster outcomes without listing delays

Predictable execution from verified buyers

You're not changing what you're selling.

You're changing who you're selling to.

HOW IT WORKS

A simple, guided process

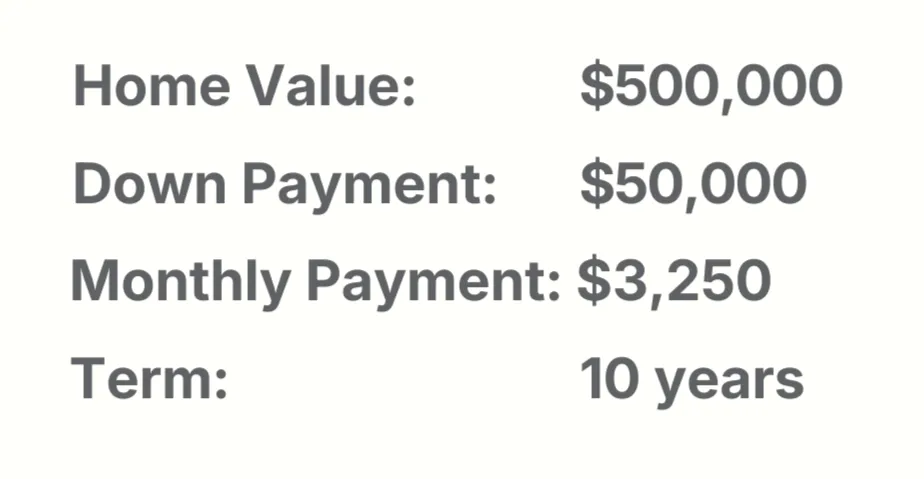

Example: Sell for full value and get paid monthly.

Example shown for illustrative purposes only.

1. Submit your property

2–3 minutes

2. Instantly matched with qualified buyers

Terms shared immediately with active funds & investors

3. Choose the best offer and close

Real offers delivered in as little as 24–72 hours

Buyers are verified for identity, entity structure, and proof of funds.

WHO SELLFI IS FOR

SellFi is built for sellers who want speed, certainty, and better outcomes without playing the traditional waiting game.

SellFi works best if you:

• Want to sell quickly without accepting a discounted cash offer

•Value real demand from professional buyers who can execute

•Are open to structured offers that maximize price and flexibility

•Want a clean, verified, professionally managed closing

Whether you’re working with an agent or not

SellFi fits naturally into the way real estate already works.

Many sellers come to SellFi through trusted real estate professionals who bring deals directly to our platform. Others come on their own, already knowing the value of avoiding cash discounts and long listing timelines.

Either way, the experience is the same:

faster offers, better execution, and fewer moving parts.

Built for modern sellers

Some sellers are financially savvy and understand the advantages of structured offers over cash.

Others simply want a better option than waiting months and negotiating price cuts.

SellFi serves both.

At its core, SellFi is about making real estate move at the speed people expect today,

more like checking out on Amazon than waiting months to sell.

SellFi is built for sellers who expect real estate to move as fast as everything else in their life.

Testimonials

Karen M., Homeowner (Arizona)

I didn’t want to discount my home to force a sell, and I didn’t want the uncertainty of listing. SellFi helped me sell on terms with a nice down payment and predictable monthly payments. The process was clean, professional, and I always knew what was happening.

Asha R., Broker / Agent (Florida)

I had clients who weren’t getting traction through traditional channels. Submitting the property on SellFi opened it up to a different buyer pool, and the home sold quickly on structured terms that worked for everyone. The process was smooth, and my commission was handled exactly as expected.

Daniel R., Investor / Buyer (Florida)

SellFi made it easy to structure a deal that worked for everyone. Terms were clear, the closing was professional, and servicing was handled efficiently. This is how modern real estate transactions should work.

Is SellFi just seller financing?

Not exactly.

SellFi is a modern marketplace that connects sellers with professional buyers who use structured payment offers instead of all cash.

While it’s similar in concept to seller financing, SellFi adds:

• Verified institutional buyers

• Professional closing and servicing

• Built-in seller protections

Think of it as seller financing rebuilt for speed, safety, and scale.

How is SellFi different from traditional seller finance?

Traditional seller financing is usually a private deal between two individuals.

SellFi modernizes the process by:

• Bringing in professional buyers and funds

• Verifying all parties upfront

• Handling closing, payments, and protections

It turns an old concept into a streamlined, professional transaction.

Who are the buyers on SellFi?

SellFi works with:

• Experienced real estate investors

• Investment groups and funds

• Professional operators acquiring multiple properties

All buyers are vetted for identity, entity structure, and proof of funds.

How fast will I get real offers?

Most sellers receive real offers within 24–72 hours of submitting their property.

Because buyers are pre-qualified and actively buying, there’s no waiting for traditional financing or showings.

Should I still list my home on the market?

Yes, many sellers do both.

SellFi works alongside the traditional market, not instead of it.

Some sellers list their home normally while also submitting it to SellFi to access a different buyer pool of professional investors and funds who can move quickly.

This gives you:

• Retail buyer exposure

• Plus fast, verified structured offers

You can simply choose the option that works best for your timeline and goals.

Will I get more than a cash offer?

Often, yes.

Cash buyers typically demand deep discounts for speed.

SellFi buyers use structured offers that frequently allow sellers to achieve stronger pricing without reducing the price.

What protects me if a buyer doesn’t perform?

SellFi includes seller protections through PayShield™.

Depending on the deal structure, this may include:

• Buyer verification

• Payment guarantees for a period

• Additional protections if issues arise

Everything is transparent before you accept an offer.

Can I still use my real estate agent?

Yes.

Many real estate professionals use SellFi as an additional buyer pool when listings stall or sellers need speed.

SellFi works alongside traditional real estate, not against it.

Is the closing process complicated?

No.

Closings are handled through a standard title and escrow process, just like a traditional sale.

SellFi coordinates everything to make it simple and fast.

Are there financial or tax advantages to selling this way?

For many sellers, yes.

Structured sales can sometimes offer benefits such as:

• Spreading income over time

• Potentially reducing immediate capital gains impact

• Creating monthly income instead of a lump sum

Every situation is different, so sellers should consult a tax professional, but many view this as a smarter financial strategy.